Review: USAA mortgage prices and you can refinance issues

It complete-services standard bank was arranged so you can suffice the most readily useful patriots; experts, active military professionals as well as their parents. USAA are a blend anywhere between a credit partnership and you can a lender offering parts of one another. Created in 1922 in San Antonio, Texas, the company has expanded to serve about 77 mil service users in this nation. USAA is not a publicly replaced business. Simply members can take part in brand new apps USAA even offers, that enables USAA to offer unique advantages and you may such as the USAA mortgage cost.

USAA now offers family re-finance cost that will be old-fashioned, variable products and more than 66 percent of its loans is backed by Virtual assistant money. This service membership is mostly about our very own military group; officials, troops in addition to their household. According to the organization, cashouts shall be repaid or, for people who find a USAA refinance since you has actually stumble on dilemmas, a loan manager commonly take a look at your position and you may tell you the loan lso are-structuring solutions. USAA functions completely co-operation with the most recent government applications.

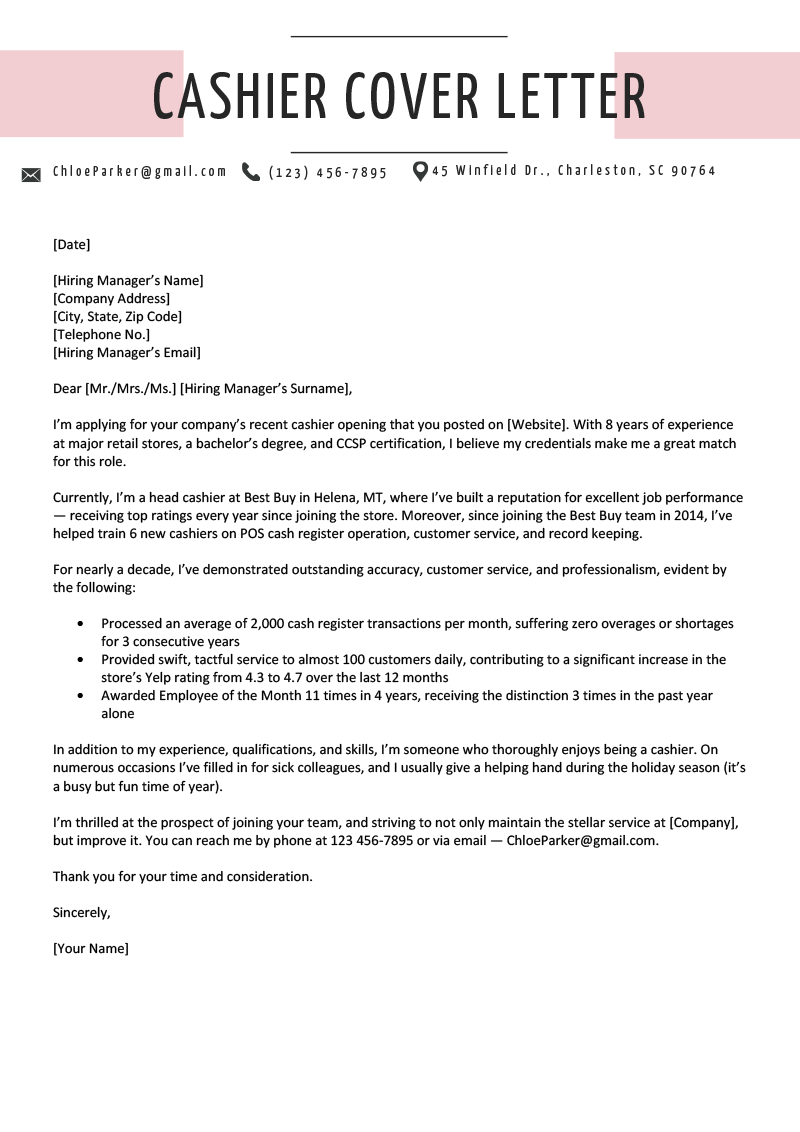

Military, retired and productive obligation, including family unit members from military personnel are eligible for USAA home loan refinance prices (Photo/Pexels)

Refinancing facts given by USAA

All loan providers render various circumstances. Examine each of USAA’s refinancing price solutions. Currently, USAA domestic re-finance applications ban household use a weblink security fund and you can family equity line of credits (HELOC).

- 30- season fixed rate

- 20-year repaired rate

- 15- year repaired speed

- 10-12 months repaired rates

Just like any fixed rate money, the speed your commit to doesn’t to change along side lives of your property financing. A fixed-rates home loan can make budgeting to suit your mortgage repayment smoother than simply that have a changeable price financial. USAA home loan rates also provides conditions ranging from ten so you’re able to 31-age. Single loved ones mortgage numbers commonly cover within $424,one hundred for every single the market limitation. To have USAA refinance rates, see their site directly, otherwise refer to them as towards the mobile phone. Generally, minimal loan amount at USAA is $fifty,100000 but could go as high as $3 million. From the repaired-rate financial solutions at the USAA consumers can refinance as much as 95 % of your worth of their home.

Sleeve loans keeps a shorter identity than simply most conventional repaired-rates home loan terms and conditions but have a tempting added bonus. Brand new quicker conditions as well as suggest lower rates of interest. You to downfall off a supply ‘s the highest monthly premiums one compliment a shorter title.

USAA does not denote new regards to Case to possess refinances, like many most other questions with USAA it’s best to buy them into the mobile phone. Pre-recognition procedure, although not, can be seen during the website: usaa. Immediately following pre-recognition is completed and you may a buy contract is within place, this site applicant normally finish the processes cost-totally free by phone. Just like any financial, the rate you can easily safe up-top relies upon your own borrowing profile and you will amount borrowed.

- Virtual assistant finance

Becoming a financial institution you to suits family members having armed forces links, it’s a good idea one to USAA’s good package is actually the USAA Va financing choices. Over half USAA’s financial team originates from Va funds. T he no-payment Va Interest Protection Refinance mortgage (IRRRL) is hard to beat some other finance companies. USAA in addition to allows Va borrowers so you can re-finance up to 100 percent of one’s property value their property. USAA structures the Virtual assistant money within the ten-, 15-, 20- and you will 29-12 months terms.

USAA home loan prices now

USAA refinance prices are competitive with other prices in the field. USAA will take a beneficial homeowner’s most recent obligations stream and background towards the attention inside the choosing a great refinancing speed. USAA’s on the web has usually do not tailored cost by the geography, credit rating, or any other pointers. To track down newest and customized prices for your financial predicament, you’ll want to call USAA actually.

How do USAA’s situations compare with almost every other banking companies?

USAA compared to. Pursue financial While entitled to an effective Virtual assistant loan, or a keen IRRRL it will be is sensible on the best way to begin your search in the USAA. While we stated, there are no charges of IRRRL financing, hence Chase you should never currently defeat. Away from IRRRL money, USAA charges good .fifty percent origination fee. If you’d like to safer a supply loan or a non-Virtual assistant fixed rates financial, shop each other finance companies. He is competitive with most other mortgage device costs as well as their origination costs will be equivalent.

USAA vs. PNC financial USAA cannot currently take a look at choice kinds of credit rating, like book payments, with regards to someone’s full borrowing profile. PNC does. Your borrowing from the bank profile would be among the portion one influence the rates. Should your credit rating needs certain solutions, however, refinancing can’t hold off, you can believe looking at PNC first, even if you are looking to secure a great Va financing.

USAA vs. Navy Government Because the another standard bank focused on offering military participants in addition to their family members contrasting Navy Federal to help you USAA to possess Virtual assistant loan opportunities is essential to have review. Whenever you are one another towns and cities state they do fifty percent or maybe more regarding the mortgage providers courtesy Va, Navy Government can not compete with no fee IRRRL you to definitely USAA offers. And, Navy Government charges increased origination fee by the .fifty percent. Bottom so you can bottom, USAA seems to eliminate ahead a touch of Navy Government.

Most other considerations whenever picking a refinance equipment

USAA will not already provide household collateral money otherwise domestic equity distinctive line of credits (HELOC). They could probably render this product on board by the end out-of 2017. USAA and will not promote the contribution during the HARP finance.

Because the USAA listens in order to the people and you will operates to ensure that they are certainly not being left trailing within this highly energized and you may altering housing and you can loan business, the firm looks purchased service and you will assistance for those spent included. Trying to compete, the business obviously respects its goal and works to improve on the overall performance particularly on tech top.

Choosing hence choice is right for you

It is advisable to comparison shop to discover the best home loan rate with respect to refinancing. By the evaluating your private situation, one can find and this facts maximize feel for you. Whenever you are eligible for USAA mortgage rates discover particular advantages to help you being aside of financial institution including the USAA IRRRL tool. Finding the right financial isn’t usually in the interest levels, furthermore far better thought customer service and you can alignment with your philosophy.

On amounts front side, there are various charges which can accompany a refi. No matter what bank considering, constantly carry out the mathematics to find out if the fresh charges counterbalance the interest. You could discover banks which have highest rates of interest could be less costly fundamentally.

Inside the a climate in which all of our service group demands the service and you will wisdom we could get a hold of, the firm is apparently a no-brainer for those from you hoping to make sure that all of our provider patriots and their families is maintained securely.