Just how much Is also A grant Save your self Me?

We all think of our primary house. Maybe your own has a roomy lawn to suit your animals in order to wander. Or perhaps it is a flat having a great view of the fresh sundown for each and every night. Even though it is an easy task to picture what you want your property to look like, the monetary element may appear more out of reach.

While we tend to mention with the all of our blog site, there are many suggests than ever before to attain homeownership today, regardless of where you are in your financial situation.

On this page, we’re going to familiarizes you with the new FHLB Give program, the history, how to be eligible for it, as well as how it will help lower your prominent, deposit, and you can settlement costs.

- What is the FHLB?

- What’s an FHLB Grant?

- How will you Meet the requirements?

- Just how much Normally A give Save Me?

What’s the FHLB?

The fresh new Federal Mortgage Lender Work (FHLB) is actually passed and you will passed inside 1932 by the Chairman Vacuum in the course of the newest High Depression. The latest Operate created Federal Mortgage Banking institutions (FHLBanks), a network away from eleven local banks that play the role of wholesalers on lendable loans. Way more merely, which means the latest FHLBanks bring funds to regional creditors having these to lend for your requirements when it comes to home financing.

The structure of your FHLBanks is very important whilst ensures local banking institutions have access to funds to get competitive and offer an excellent particular mortgage applications so you can consumers.

What is actually an FHLB Give?

FHLB Grants are around for qualifying homeowners and can be used to reduce the prominent or wade to your down payment and you may settlement costs.

These types of FHLB Has try registered from the Reasonable Houses Program (AHP), so you might locate them often referred to as AHP Features. The brand new AHP was created in 1990 which will be funded from the FHLBanks. Per lender contributes ten% of its money so you can the AHP, towards intention of providing reduced and you can average-income home go homeownership.

How will you Meet the requirements?

Basic Customs Mortgage is actually satisfied to provide the Reasonable Homes System to include eligible reasonable-to-moderateincome family members and folks which have a give from $seven,five hundred to $10,one hundred thousand towards their property purchase.

Speak with the first Traditions Home loan officer to understand in the event the their community fits brand new certification from an effective COVID-19 associated essential worker.

So you can qualify for owner-occupied has, meaning that the house will probably be your no. 1 household, your family members earnings need to be 80% otherwise less of your own county’s average money.

There are even features designed for rental properties in which at least 20% of your equipment was affordable getting and you will filled from the really low-income homes, recognized as income on 50% otherwise a reduced amount of brand new average county income.

Simultaneously, you will find designations such as for example community partners, which include important community participants which assist anyone else to have a living. Law enforcement, instructors, medical care workers, firefighters, or other earliest responders, and pros and you may active-obligations armed forces end up in this community. For additional information on how to qualify for this group, it’s best to consult a loan administrator, as they are gurus within these programs.

This new applications you can expect initially Traditions Home loan render reasonable-to-modest earnings parents and other people between $seven,five hundred and you will $10,100000 on the their residence buy.

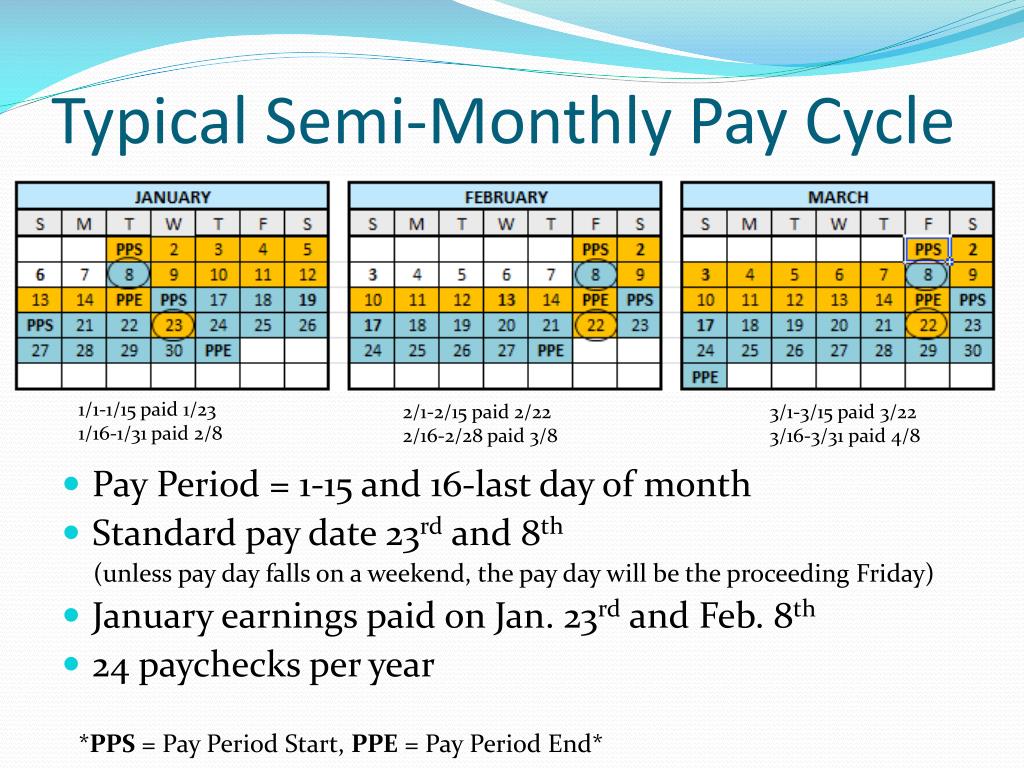

To produce a bona fide-community scenario, take a look at exactly how a great homebuyer in the New york could save $21,777 on the settlement costs from the Vermont Household Virtue Home loan System (NCHFA), a seller out of FHLB Features. Then they have to put down simply $dos,096 as well as their payment increases of the simply $80.

If you’re taking advantage of a keen FHLB Grant, or some other system, it is very important be aware that many programs are around for let you accomplish your goal, while don’t have to locate them oneself.

Apply to a primary Customs Mortgage loan officer that will remark your own financial predicament and reputation one to take advantage of a knowledgeable mortgage program to you.

Matter

- To order property

- Deposit

- First-go out Homebuyer

- Financing Choices

The brand new included stuff is intended having informative intentions merely and should not relied through to just like the professional advice. Additional terms and conditions incorporate. Not totally all candidates have a tendency to meet the requirements. Talk to a financing top-notch to possess taxation recommendations otherwise home financing top-notch to deal with their financial concerns otherwise issues. This is certainly an advertisement. Waiting step 3/9/2022.

The item Or Services Was not Recognized Otherwise Recommended By People Political Agencies, And this Give Isnt Getting From A company From The government. To find out more and extra criteria of your own New york Household Advantage Financial System, kindly visit: nchfa.

With NCHFA + FHLB funding according to research by the home conversion speed shown on the graph over with an initial and you can second financial. First-mortgage was a 30-12 months FHA fixed-rate loan which have % CLTV, 3.625% rate of interest, and you may 4.818% Apr. Next mortgage try an effective fifteen-12 months repaired-speed financing having 0% interest. This new monthly payment includes combined principal and you will focus into first and next mortgage as well as projected charges to possess fees, homeowners insurance, and home loan insurance coverage.

As opposed to NCHFA + FHLB resource based on the domestic sales speed shown throughout the chart above having a thirty-season FHA fixed-price mortgage, $12,950 advance payment matter, step three.625% interest, and http://clickcashadvance.com/personal-loans-nc/hudson you may 4.818% Apr. The new payment boasts projected charge to own taxes, homeowners insurance, and you may home loan insurance coverage.

Standards to possess financing system certification and you may rates to the loan apps are different according to credit criteria, total number from deposit, and they are at the mercy of market rates. . Prices work and you may subject to transform without notice. The new stated variety get alter or not be accessible on lifetime of partnership or lock-in the. This might be an advertising and never a pledge out-of lending. Terms and conditions incorporate. All approvals susceptible to underwriting guidance. Wishing .